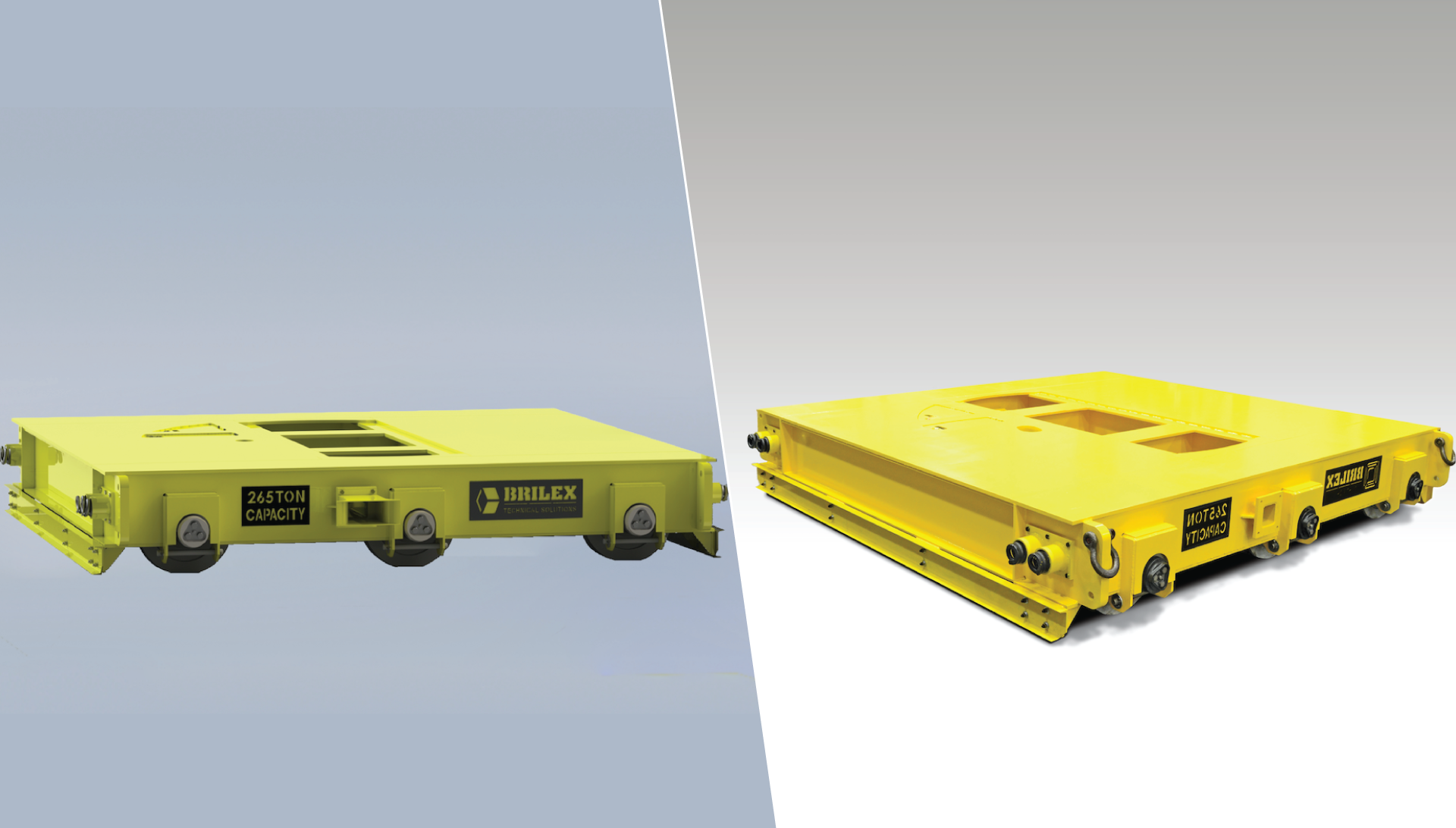

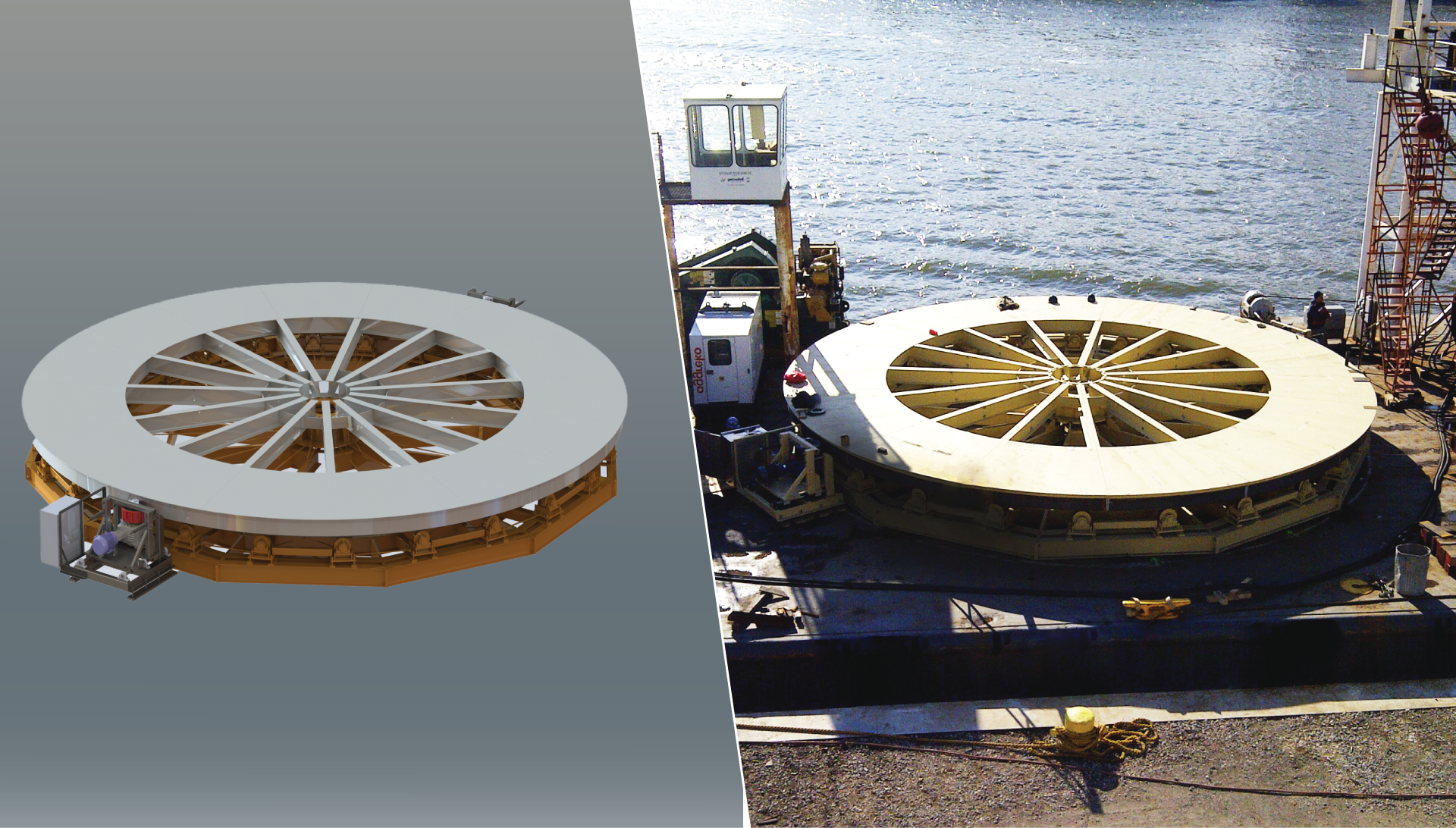

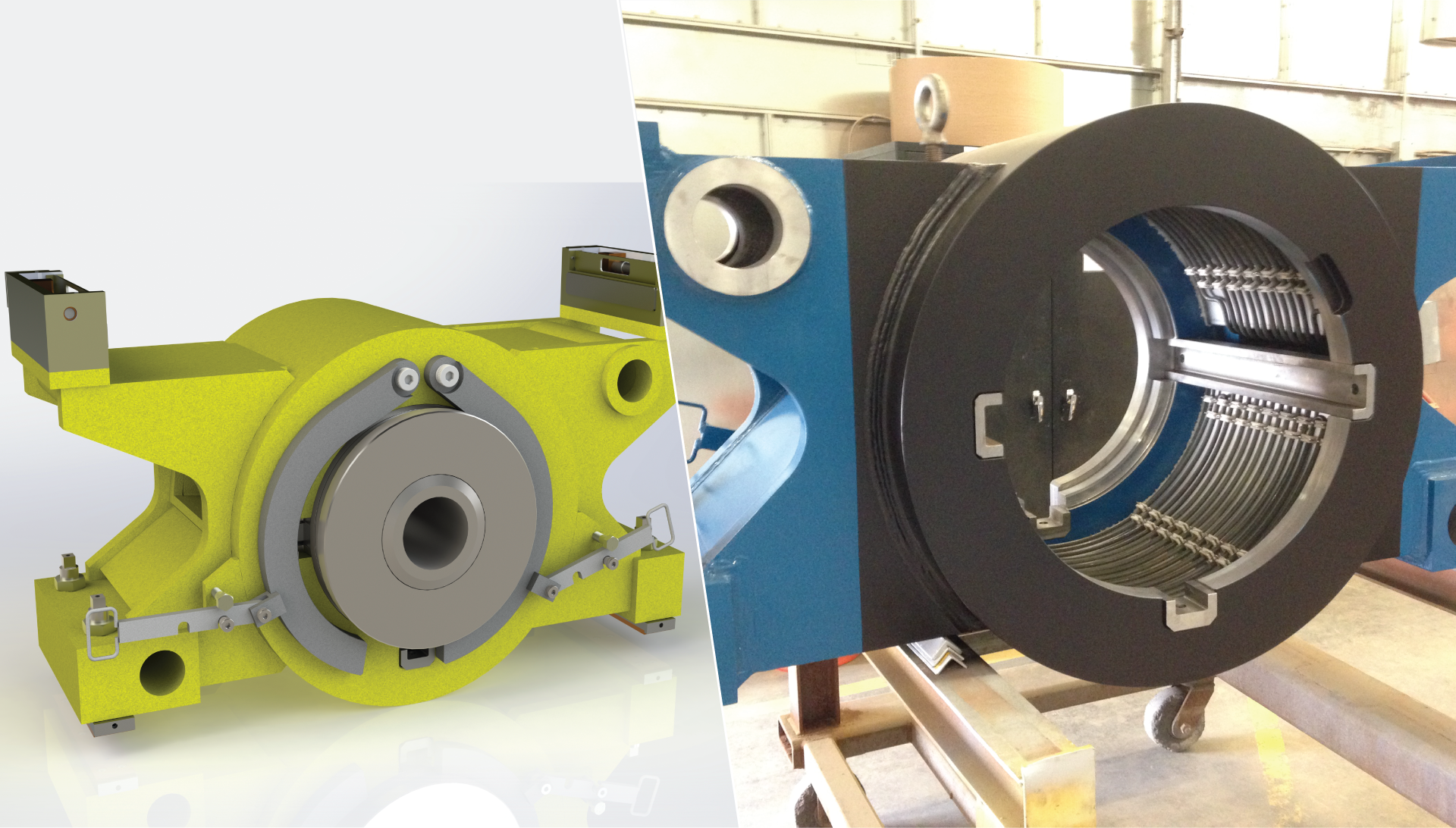

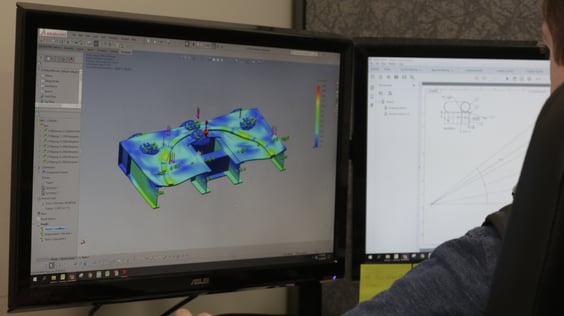

Expert Experience

Your design or manufacturing challenge won’t faze our professional engineers -- they’ve seen it all during Brilex Industries’ 30+ years. Our organic growth allows us to lend expert skill and precision today across a wide variety of industries.

Does your capital equipment project require a heavy-duty engineering solution from an experienced partner?

Does your capital equipment project require a heavy-duty engineering solution from an experienced partner?